One thing that is often touted about being a homeowner is the tax benefits. While it is true there are often tax benefits to owning a home, many times they are overstated. If you are considering a home purchase and the thought of reducing your taxes is a major consideration, you need to understand how those tax benefits actually work. The focus of this discussion is what tax benefits a homeowner receives on an annual basis and how to evaluate what benefit you are actually receiving.

The Tax Benefits

The IRS allows you to deduct the interest you pay on your mortgage on Schedule A of your tax return. Schedule A is where you itemize your deductions. Being able to deduct the mortgage interest effectively reduces the interest rate you pay on your mortgage, but the value of the deduction is going to vary depending on a person’s tax situation. This is usually the largest benefit of using a mortgage to purchase a home.

Owning a home also comes with another tax deduction – real estate taxes. The (typically) thousands of dollars a homeowner pays based on the value of his or her house is also deductible on Schedule A. While the deduction is nice, we should acknowledge real estate taxes are nothing more than an expense.

Those who have don’t have 20% equity in their home will also likely have to pay for PMI (private mortgage insurance). This is also tax deductible on Schedule A, but like real estate taxes it is simply an expense. You do not want to pay PMI if you can avoid it.

If you paid close attention, you will notice that all three of the tax “benefits” listed above are itemized deductions on a Schedule A.

How to Calculate The True Tax Benefits

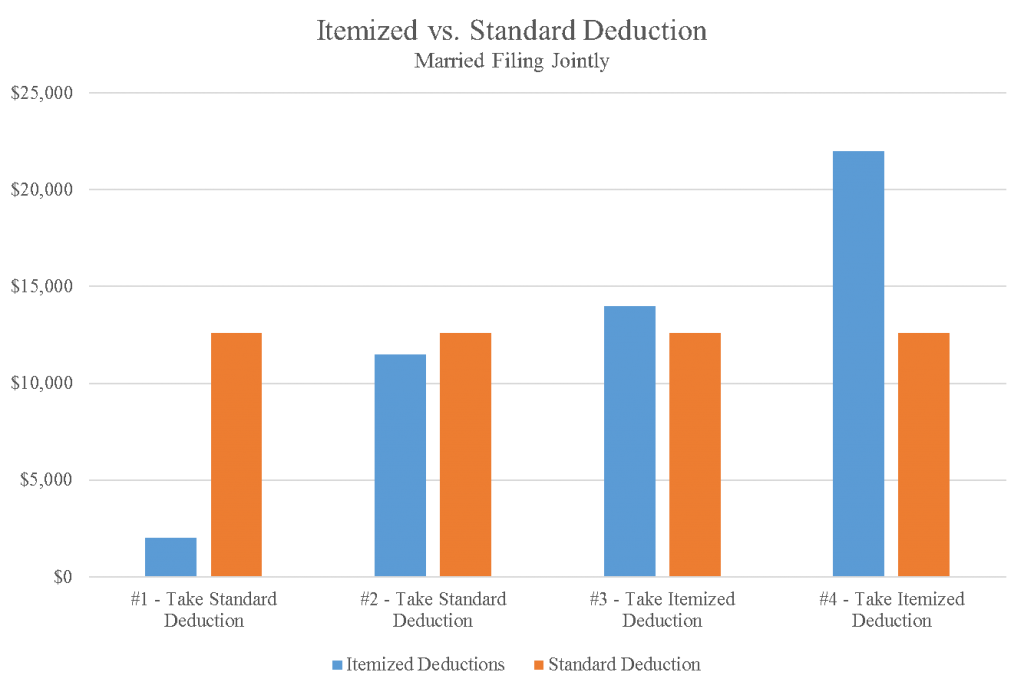

Any taxpayer has the option to itemize their deductions or take a standard deduction. A standard deduction is a set amount you can deduct regardless of whether you have anything to itemize or not. For 2016, the standard deduction for single taxpayers is $6,300 and $12,600 for married taxpayers filing jointly.

EXAMPLE 1: If a married couple calculated that they only had $2,000 in itemized deductions, then they can claim the standard deduction of $12,600. Thus, the standard deduction becomes the lowest deduction you will take and itemized deductions less than this are of no value to you.

EXAMPLE 2: Consider a married homeowner who pays $4,000 in real estate taxes, $1,500 in PMI, and $6,000 in mortgage interest. They are paying $11,500 in deductible expenses related to their home, but is it bringing value to them? If they don’t have any additional itemized deductions, the answer is “No!” because the standard deduction is still higher than the itemized deductions. For this couple, they have not received a single penny of tax benefit from the house!

See the graph at the end of the post for visuals of these examples.

So now you may be wondering, what other itemized deductions are available? There are actually a very large number of deductions that can be itemized, but the reality is that most people are not able to itemize them. Common deductions that people aren’t able to itemize (for reasons not discussed here) are medical expenses, union dues, casualty losses, and unreimbursed employee expenses. There are two items that many people can itemize, though – gifts to charity and either sales taxes (useful in Texas) or state income taxes (possibly useful for people in states that have an income tax).

EXAMPLE 3: Let’s consider the married homeowner again, but this time they also deduct $1,000 in sales taxes and give $1,500 to charity. When added to the itemized deductions arising out of owning their home, they now have $14,000 in itemized deductions. Since $14,000 is $1,400 larger than the standard deduction, they are finally able to itemize and receive additional tax benefits. If they are in the 25% tax bracket, the extra $1,400 deduction is worth $350 in tax savings.

Finally, our couple is realizing a tax benefit to homeownership! If they hadn’t owned a home, they wouldn’t have been able to itemize their deduction and save $350 in taxes. Of course, if they hadn’t given money to charity, they also wouldn’t have been able to itemize. So what is causing the tax benefit, the mortgage or the charitable gifting? If you want, you can decide to mentally allocate the tax benefit to either one, but you cannot allocate the entire $350 tax benefit to each or you’d be making a mental mistake.

This means if the couple chose to mentally allocate the $350 tax savings to the $6,000 they spent on mortgage interest, they cannot allocate any portion of the same $350 to the charitable contributions. The best way to allocate the savings is on a pro-rata basis.

($6,000 mortgage interest) / ($14,000 total deductions) = 42.9%

This formula tells us that 42.9% of the tax benefit was actually due to the mortgage interest. Let’s go ahead and finish out this calculation and see what the end result is for the homeowner.

($350 tax savings) x (42.9%) = ($150 tax savings due to mortgage interest)

($6,000 mortgage interest) – ($150 tax savings) = ($5,850 mortgage interest after tax savings)

What you can see is that tax benefits do begin to accrue after a taxpayer is able to itemize deductions, but the benefits can be small. If this couple was paying 4% interest on their mortgage, after accounting for the tax benefit the effective interest rate on the mortgage would be 3.9%. Let’s look at one final example to see where the tax benefits of homeownership, and mortgage interest in particular, begin to accrue.

EXAMPLE 4: The same couple get start earning more income and decide they want to give more money to their church. Instead of giving $1,500 to charity, they give $9,500. The increase causes their itemized deductions to go from $14,000 to $22,000. Now what do their tax savings and effective mortgage interest rate look like?

If we continue to assume the couple are in the 25% tax bracket, they now have $2,350 more in tax savings than just taking the standard deduction. Let’s work out the rest of the equations:

($6,000 mortgage interest) / ($22,000 total deductions) = 27.3%

($2,350 tax savings) x (27.3%) = ($557 tax savings due to mortgage interest)

($6,000 mortgage interest) – ($557 tax savings) = ($5,443 mortgage interest after tax savings)

Assuming the couple is paying 4% interest on their mortgage, the effective interest rate becomes 3.6% after accounting for the tax savings of itemizing over taking a standard deduction.

Conclusion

In the end, what do all these formulas and numbers mean? They are simply an illustration that being a homeowner may or may not have a tax benefit. If you want to truly analyze the cost of purchasing a home, the tax savings should be considered, but the analysis is far from simple.

Some key takeaways:

- To determine the true value of the tax deductions arising from homeownership, a person must consider the standard deduction.

- The more itemized deductions a person has outside of homeownership, the more valuable the tax benefits of having a mortgage.

- The higher a taxpayer’s taxable income is, the more valuable the deduction is in tax dollars saved.

- Once taxpayers begin to have substantial adjusted gross income, itemized deductions begin phasing out (surprise, this “Pease Limitation” wasn’t even discussed)!

If you are considering buying a home, refinancing a mortgage, or purchasing rental property and want to understand the tax implications of your situation, contact me.