How does the IRS Measure Income?

Many taxpayers find the Federal tax system overwhelming because of what can seem like absurd concepts. When most Americans think of income they think of their paycheck, business earnings, or interest and dividends. When the Internal Revenue Service refers to income it may be talking about any number of things – earned income, passive income, investment income, gross income, adjusted gross income, modified adjusted gross income, taxable income, and more.

The IRS actually measures the different types of income for different purposes. While all the types of income are important, it is crucial for everyone to understand two types of income in order to make informed tax decisions – adjusted gross income and taxable income.

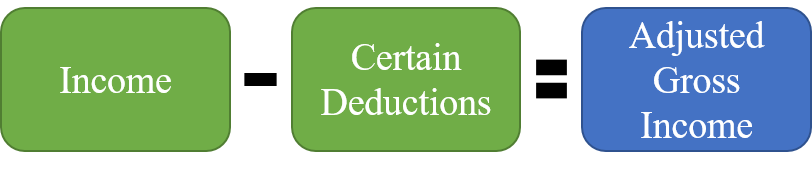

Adjusted Gross Income (AGI)

Adjusted gross income (AGI) is the total income you report on your tax return, less a few specific deductions. Most deductions you may be familiar with, such as mortgage interest, real estate taxes, and charitable contributions, do not reduce your AGI. Some examples of deductions that could reduce AGI are Traditional IRA contributions, student loan interest, health savings account contributions, and alimony payments.

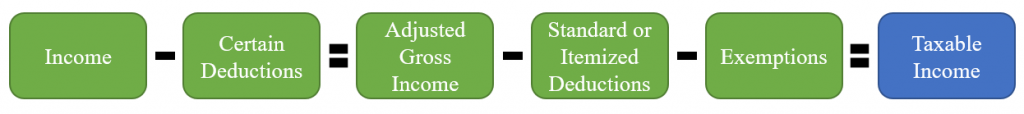

Taxable Income

Once you have your AGI calculated, you get to deduct a few more things to come up with your taxable income. This is where you can take out the goodies like mortgage interest and charitable contributions if you itemize your taxes. You can also reduce your taxable income because of exemptions you are allowed for each member of your family.

Why Should I Care?: Adjusted Gross Income Examples

What makes these two incomes important are that many different credits, phase-outs, and deductions are keyed off them.

Let’s look at just a couple of scenarios that are affected by the value of AGI.

- A married couple, Kevin and Karen, have two kids under the age of 17. Each spouse works as an employee and makes $60,000 per year. It is likely the AGI of Kevin and Karen is high enough that their Child Tax Credit is being phased out by $50 for every $1000 they make over the threshold. This comes to a hidden 5% tax. In most circumstances, they will already be paying a 25% marginal tax rate, so when you add in the Child Tax Credit phase-out, they are actually paying a 30% rate! But that isn’t all. They are also paying payroll taxes directly from their paycheck to the tune of 7.65%, for a total marginal tax rate of 37.65%! You would think they were in the top 1% of earners with a tax rate that high, but alas, they aren’t.

- Jack and Jill each work, have an AGI of about $128,000 per year total, and have a young child. They are also having their Child Tax Credit phased out, but their situation is a bit more complicated. Jill is attending school to get her MBA. Their income disqualifies them from receiving any credits for Jill’s education expenses, but they are still able to take a partial tuition deduction. Jack receives an unexpected bonus of $5,000, pushing their AGI to $133,000. How does this affect them? Well, two ways. First, the bonus is subject to the 30% tax rate (25% marginal rate plus 5% child tax credit phase-out) – that is $1,500 of the bonus in taxes. Second, their AGI has moved above $130,000, causing them to lose $2,000 of their tuition deduction. The $2,000 deduction was worth $600 in tax savings to them. The end result of the $5,000 bonus was $2,100 in additional taxes! That’s a 42% tax rate; if we throw the payroll tax rate of 7.65% on top, Jack just had to pay 49.65% of his bonus to the Federal government!

Both of these examples are of families making low six-figure incomes, so AGI concerns only apply to those making that sort of money, right? Nope.

- Ted is a young man just entering the workforce. He makes $20,000 per year and lives very modestly. Ted made the wise decision to contribute 5% of his pay, or $1,000, to his employer’s 401(k) plan in order to receive a matching contribution for his retirement. What Ted doesn’t know is that if he had only put in another $500 into the 401(k) plan or a Traditional IRA, it would have reduced his taxes by $600. You read that right – by saving $500 more for retirement, Ted would have gotten an additional $600 in tax savings. In a sense, the government would have paid Ted $100 to let the government put $500 in his retirement account. Yippie!

All three of these examples are simplified because of the complexity of the tax code, but the scenarios are accurate.

Why should I Care about Taxable Income?

This one is much easier – how much you pay in taxes if figured directly off your taxable income! The lower you can push this number, the less your total taxes will be.

Knowledge Is Key

In all three circumstances above it is possible the taxpayers could have substantially improved their situation with a small amount of effort. What they all lacked was a knowledge of the tax code and ways to use it for their advantage. Many people have opportunities to save hundreds or thousands of dollar in taxes, but haven’t sought out the advice of a knowledgeable professional. Though few people realize it, tax planning can pay off big for taxpayers of all types. If you wonder if you could improve your tax situation with some planning, contact Cates Tax Advisory for a consultation.