Evaluating Health Insurance Options

One of the most challenging financial tasks for many Americans is evaluating health insurance and the different options they are presented with. This comes into play for many people during their employer’s annual open enrollment. Even those who don’t have employer group coverage have to evaluate options on the health insurance exchanges or those provided by an agent. When presented with several different options, many people don’t look beyond the monthly premium and annual deductible.

This post is the first in a series discussing some of the ways to help evaluate health insurance options. Just like purchasing any insurance product, it is not possible to know which is the best option because we can’t know the future. What you can do, though, is choose the plan that has the highest likelihood of saving you money.

Insurance Fundamental: Protecting Against Tail Risk

Properly used, all forms of insurance you purchase should be structured to protect you from tail risk. Tail risk is an unlikely and catastrophic event. For example, getting into a minor fender-bender in a vehicle that costs $1,000 to repair is not tail risk. The probability of this happening is fairly small (depending on your driving habits!) but the $1,000 expense is not catastrophic. You should establish an emergency savings account to handle the expense. By handling the expense yourself, you have essentially self-insured the minor risks.

On the flip-side, causing a car wreck going 70 mph on the highway could easily be catastrophic – damage to vehicles and liability for medical expenses can quickly run into hundreds of thousands of dollars. If a person doesn’t have the proper auto insurance, they could become personally liable for much of the bill. Most people cannot and should not self-insure this type of risk.

The same principle applies to health insurance. You need health insurance to protect you against a catastrophic event, but you don’t need it to protect you from paying full price for a few doctor’s office visits.

Step One: Compare Premiums

The first step to evaluating health insurance options is to look at the premiums (how much you have to pay each month or each paycheck). Typically, the higher the premium, the lower the deductible and out-of-pocket maximums. The best thing to do is to calculate the annual cost of the premiums.

In order to work through the steps, we are going to use some actual figures from an employer health insurance plan. This particular employer has four different health insurance options, but we are only going to look at two for our example:

- The “Gold plan” has the highest premium and the best benefits.

- $10,351.90 annual premium the employee must pay for a family of four.

- The “Basic plan” as the lowest premium and the lowest benefits.

- $3,438.24 annual premium the employee must pay for a family of four.

While both plans protect against tail risk, the basic plan strips out coverage for people who want to pay a lower premium and self-insure some risk. By deciding to self-insure some risk, the employee starts out paying $6,913.66 less. That’s a good chunk of money!

Step Two: Estimate Typical Annual Medical Expenses

The second step is where you try to estimate your typical or expected annual medical expenses. While seeing the future isn’t possible, often times we can make reasonable estimates based on current health and past medical expenses.

When evaluating prior medical expenses, it is important to see what the allowed expenses were on your health insurance EOB (Explanation of Benefits). If you look at the insurance EOB, which you can pull up online, you will usually notice different expense amounts listed for any procedure. The largest amount is often an amount the healthcare provider billed to the insurance company – you can ignore this amount. The insurance company then has an allowed expense (this is the figure you want) that was negotiated with the provider. Finally, you may have actually paid a different amount if you reached your deductible. For correct calculations, you need to pull the allowed expense (the negotiated amount) from the insurance company EOBs.

Once you have a reasonable estimate of your medical expenses, move to Step Three.

Step Three: Apply Deductibles, Coinsurance, and Out-of-Pocket Maximums

The third step is to apply the reasonable estimate of your medical expenses to the benefits provided by the health insurance options. Let’s continue the example of the Gold Plan and Basic Plan using different estimates of allowed medical expenses – $5,000, $10,000, $20,000, $30,000, $40,000 and $50,000 during the year. We assume all expenses are with in-network medical providers.

- Gold Plan

- Deductible: $500 individual / $1,000 family

- Coinsurance: 20%

- Out-of-pocket maximum: $5,350 individual / $10,700 family

- Basic Plan

- Deductible: $4,000 individual / $8,000 family

- Coinsurance: 40%

- Out-of-pocket maximum: $7,350 individual / $14,700 family

Since the insurance benefits are for a family, we have to allocate the allowed expenses between the family members. For the example, we will assume two family members each account for half of the medical expenses and the other two family members don’t incur any medical expenses.

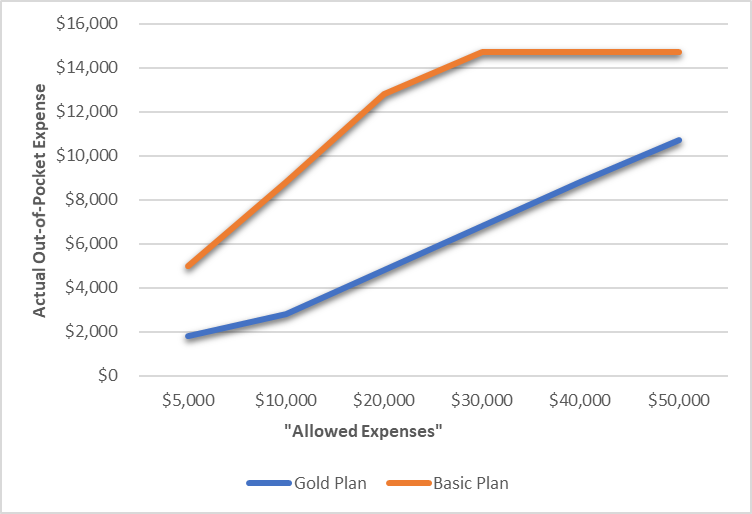

Out-of-Pocket Medical Expenses (expenses accrued by two family members)

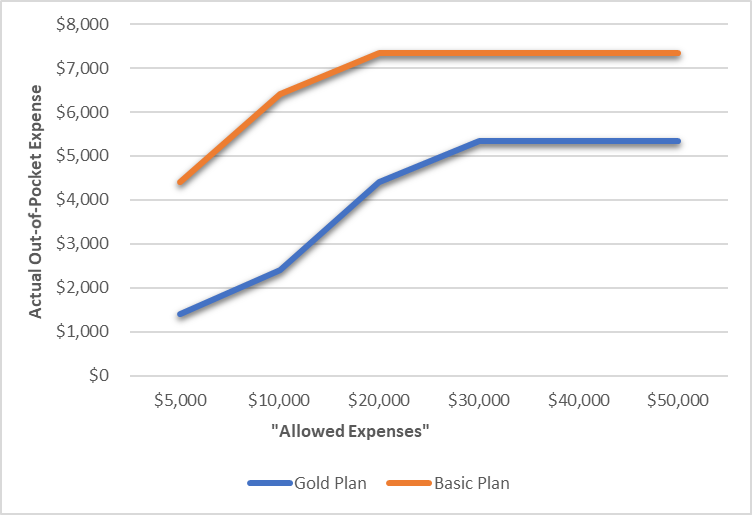

As expected, the out-of-pocket cost for the Basic Plan is higher than the Gold Plan. Since there are numerous possible variables for the medical expenses, let’s look at one more comparison. This time all the allowed medical expenses will accrue to one member of the family with the other three members not incurring any medical expenses.

Out-of-Pocket Medical Expenses (expenses accrued by one family member)

Step Four: Combine the Expenses from Steps One and Three

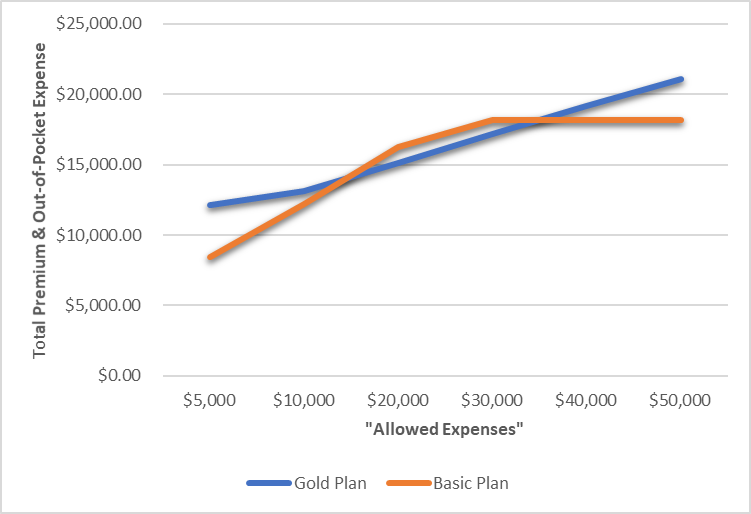

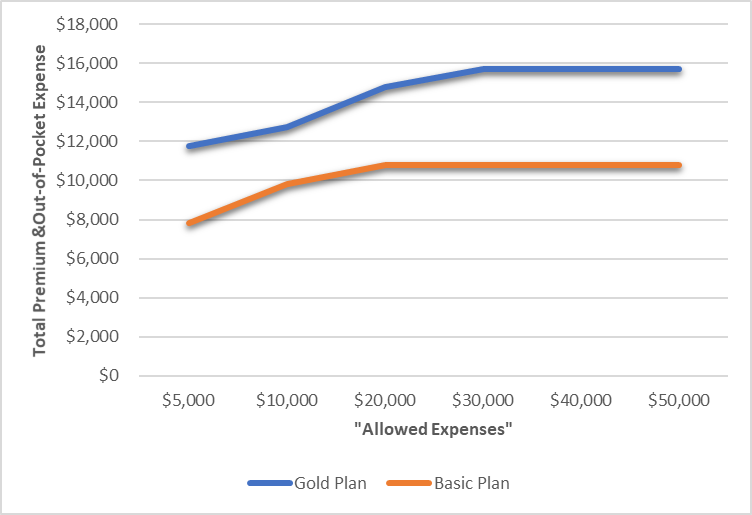

Finally, all we need to do is add in the premium expenses from Step One to the calculated out-of-pocket expense in Step Three. Once we add those in, we get the following results:

Total Medical Expenses (expenses accrued by two family members)

Total Medical Expenses (expenses accrued by one family member)

When we bring the cost of the premium into these two scenarios, we see how the Basic Plan actually costs thousands of dollars less than the Gold Plan the majority of the time! The reason why is the Gold Plan costs so much more in premium than the Basic Plan. Unless a family is unable to save enough money to sufficiently cover the out-of-pocket expenses, they are most likely going to benefit by choosing the Basic Plan.

Additional Considerations

It is very important not to skip Step Three and do an estimate of your personal situation; there are numerous different scenarios and we only looked at a small range of possibilities.

Other factors you will want to consider when making a decision:

- Do you have the financial reserves necessary for the higher out-of-pocket costs associated with a high deductible (Basic) plan?

- If you experience significant medical expenses, it is likely a plan similar to our “Gold Plan” will provide superior tax benefits to a “Basic Plan.”

- Are you able to utilize an FSA?

- Are you able to utilize an HSA?

- Does your employer contribute to an HSA for you?

- Pharmacy benefits were not considered in our examples.

- Do you use out-of-network medical providers?

- Are copays part of your plan options?

- And more depending on your situation.

Summary

The comparison of different health insurance plans is almost always an onerous endeavor, but is usually worth the time. It is possible a thorough analysis can save you thousands of dollars.

If you have any questions about health insurance in general, or about an analysis in particular, please don’t hesitate to contact me.