The last post discussed how the often touted mortgage interest deduction is not as beneficial to many people as is commonly thought. So the question is, what is often the best tax break available to homeowners? The answer is simple… the home sale exclusion. We will discuss how this tax break bestowed on homeowners can save tens-of-thousands of tax dollars, as well as the rules you need to know.

What is the Home Sale Exclusion?

The home sale exclusion is the ability to exclude $250,000 in capital gains for single taxpayers and $500,000 in capital gains for married filing joint (MFJ) taxpayers from taxation. The exclusion applies to your primary home you live in.

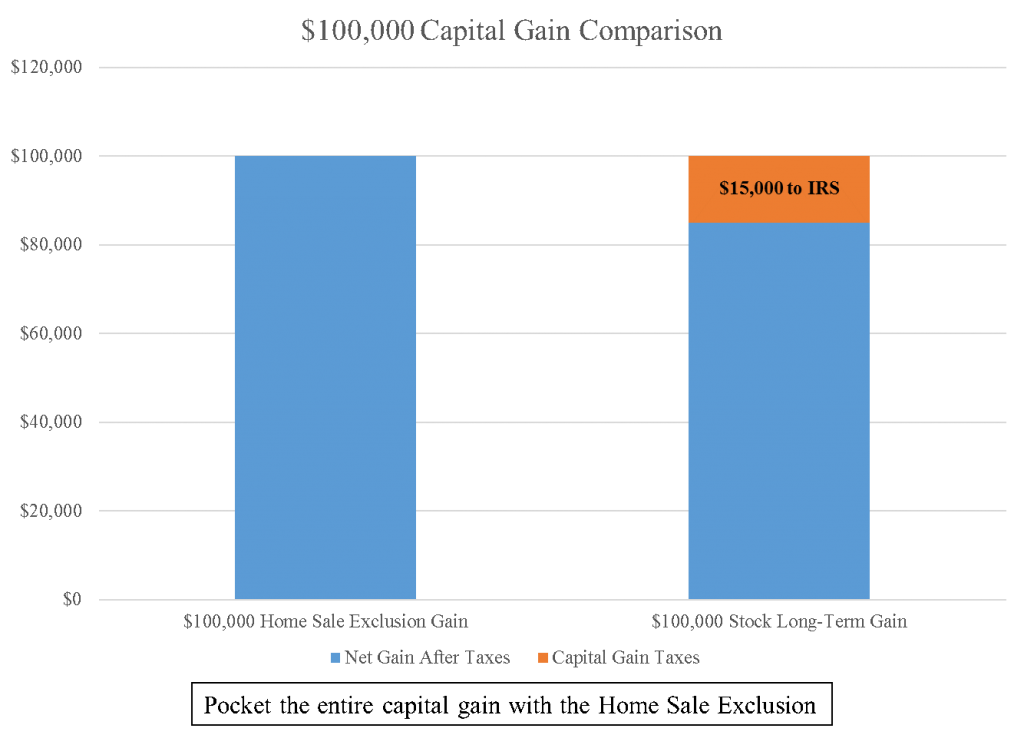

That begs the question, what is a capital gain? In the simplest of terms, capital gains are the profit you make off the increase in value of a capital investment (home, collectible car, stock, etc.). If you bought your house for $100,000 ten years ago and sold it this year for $200,000, then you would have a $100,000 capital gain. But thanks to the home sale exclusion, you would not even have to report the capital gain on your tax return, let alone pay taxes on it. If that same person had $100,000 in capital gains on a stock, they would owe $15,000 in taxes if they were in the 15% capital gains tax bracket.

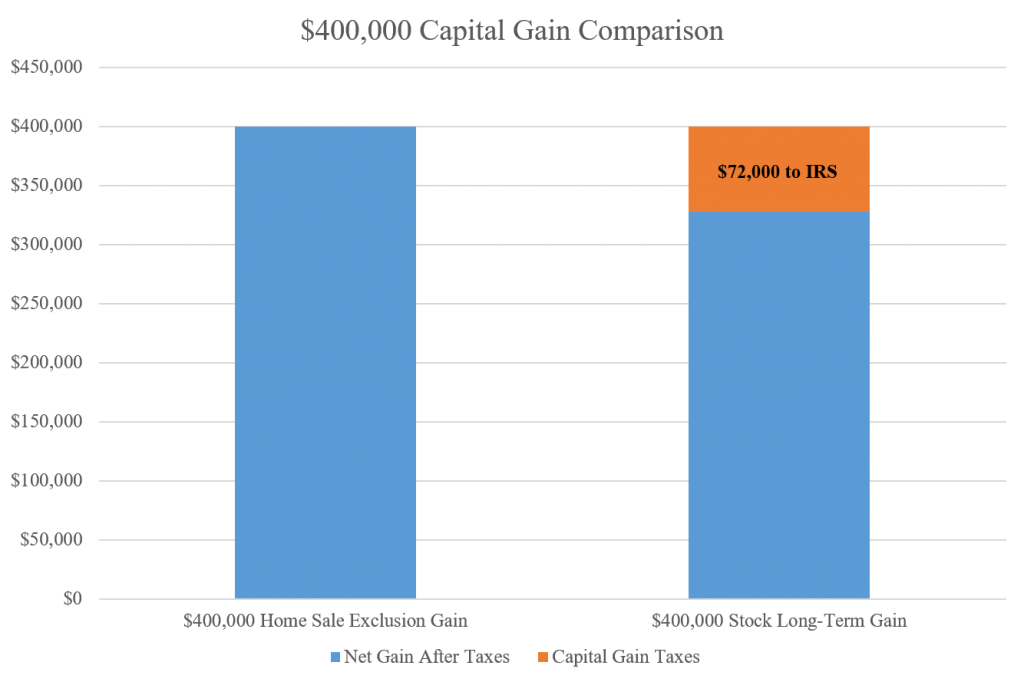

To help illustrate how valuable this tax break is, let’s look at two more examples with capital gains – one qualifying for the home sale exclusion and one from stocks. What if it was a married couple made a whopping $400,000 on their home? No tax. What about the same couple with a taxable income of $100,000 who make $400,000 on stocks? Because there is not an exclusion for stocks, now their tax bill on the capital gain is north of a whopping $72,000 (including 3.8% Medicare surtax)!

Think about it, not only do you get to live in and enjoy the home, you also get a gigantic tax break if you make money on the house.

Two of Last Five Years

The first thing you need to know is that you must live in the home as your primary residence for at least two of the last five years. There are a number of ways this rule can come into play, but let’s just look at a couple.

Converting a Home to a Rental

It is relatively popular strategy for people to keep their home for a rental property when moving into a new home. As long as they lived in the original home for at least two years, they have three years after they vacate the property where they can sell it and exclude any gains. This strategy is particularly effective if they aren’t certain they want to be long term landlords, but feel like the property market will continue rising for the next few years.

The problem is once the original home has been a rental property for three years and one day, all capital gains now become taxable. That includes any price appreciation that took place while they lived in the home plus appreciation while it was a rental property. If they planned to sell the property but waited just a tad bit too long, it could cost them tens-of-thousands of dollars. You MUST know the rules.

Vacation Home

If you have a vacation or second home, only your primary home will qualify for the exclusion. Suppose you are living in Texas and have a vacation home in Colorado, but you just retired and really want to sell both homes and move to Florida. You can sell your Texas home, no problem, since it is your primary home and exclude up to $500,000 in capital gains if you are MFJ.

What do you do about your vacation home, which just happens to have $300,000 in capital gains? If you sell it you could face a huge tax hit, easily $50,000 or more. Well, you could take a tax tip from your tax advisor and live in the vacation home for two years before moving to Florida. By living in the vacation home for two years, now it also qualifies for the home sale exclusion. If you are lucky, the house will even increase a little more in value. Having the home sale exclusion shield your capital gains from taxes is as if the IRS was paying you $50,000-plus dollars to live in the vacation home for two years! How is that for a good deal?

How Do I Calculate my Gain?

You gain is calculated based on the cost basis of your home. I know, you are saying, “Great, another tax term.”

Cost basis is an accounting term for the value of your home for tax purposes. When you first buy your home, the cost basis is essentially the purchase price. The thing is, your cost basis will go up (or down) based on decisions you make. Did you remodel the kitchen? Did you add a bedroom? How about refinance your mortgage? Doing those things will add to your cost basis, so be sure that you keep track of your capital expenses, or at least throw all the paperwork in a box so you can calculate the cost basis in the future. This is an important thing to remember, particularly if you are in the house for a long time, as discussed below. Minor repairs and upkeep do not add to the home’s cost basis.

Once you know your cost basis, you just subtract it from how much you sell the home for. For example, if you bought your house years ago for $350,000 and sold it this year for $900,000, you would have $550,000 in capital gains; if you are MFJ, you can exclude $500,000 of the gains, but you will owe taxes on the additional $50,000. You can figure that will be $7,500 or more in taxes.

Luckily, you are good at recordkeeping and saved the work invoices for the $100,000 in remodels you did over the years. When you add in the remodeling costs to your original purchase, your cost basis becomes $450,000, your gain becomes $450,000, and you get to exclude all of the gain. Keeping those records just saved you $7,500 in taxes!

Will my House Really Go Up That Much in Value?

The answer is simple… no one knows. Real estate is a tricky thing to gauge and also varies significantly by geographic area. If you adjust the historical increase in housing prices by the increase in house size (square footage) over time, we can conservatively figure homes will increase by about the rate of inflation. Let’s assume that inflation is 3 percent. With 3 percent annual price increases a $250,000 house would be worth $500,000 in 23 years, thus having $250,000 in capital gains.

Assuming housing prices increase just a little faster than 3%, but actually at 4%, and your $250,000 house would double in about 18 years. The same house would be worth $810,849 if you were to stay in the house for 30 years at 4% annual appreciation. Now the house has capital gains of $560,849.

Your experience may be better, or worse, than the hypothetical examples above. What you need to take away is that house can often see large price increases over long periods of time. And that is why the home sale exclusion is such a valuable tax benefit. The higher the initial value of the home and the longer you live in it, the more likely you are to see significant increases in its value.

Conclusion

Most Americans consider their home a valuable asset and many have a huge portion of their net worth in their home. In order to encourage home ownership, Congress created the home sale exclusion for capital gains that accrue in Americans’ homes. Knowing and understanding how the exclusion works can help you make wise financial decisions and increase your net worth. It is important to note we have not covered every aspect of this important tax benefit. Do not make any decisions based on this commentary alone; please consult your tax advisor.

Click here to sign up to receive an email each time Cates Tax Advisory posts a new blog.