What is an Enrolled Agent (EA)?

An Enrolled Agent is the only federally licensed tax professional.

When it comes to tax professionals, most people immediately think of a Certified Public Accountant, commonly referred to as a CPA. There other tax professionals to be aware of, particularly tax attorneys and Enrolled Agents. Tax attorneys are lawyers who specialize in tax law. Enrolled Agents are tax professionals who have passed a series of exams and earned a credential administered directly by the IRS. Public knowledge of Enrolled Agents varies significantly by geographic location. For example, in California the public is much more aware of EAs than in Texas.

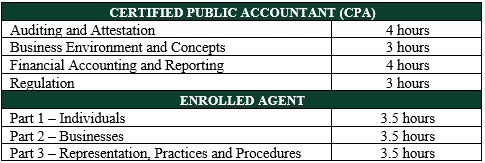

Comparing the CPA Exam with the EA Exam

The CPA exams are much broader in scope than the EA exams. There are four exams required to qualify as a CPA and three exams to qualify as an Enrolled Agent. Let’s take a look at the exams.

The CPA exams cover a very wide range of topics, from auditing to financial accounting to taxation. The Regulation exam is the primary exam focused on taxation. The EA exams focus solely on Federal income taxation. The key takeaway is that an Enrolled Agent specializes in Federal income tax, while a Certified Public Accountant has to show a mastery in a large range of topics.

Because the CPA exam covers so many concepts, it is widely considered a tough credential to earn. Becoming a CPA is nothing to sneeze at and is appropriately respected by the public. The Enrolled Agent credential would not be appropriate for a professional doing audit or managerial accounting at a corporation. The Enrolled Agent credential is appropriate for individuals and businesses looking for tax planning, tax advising, or tax preparation.

In summary, the CPA is a more difficult set of exams due to the breadth of knowledge required, while the EA exams are difficult but focus solely on Federal income taxation. For people looking for someone to prepare their tax returns or advise on tax matters, an EA is often as capable as a CPA.

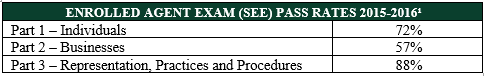

EA Exam Pass Rate

The Enrolled Agent exams are technically called the Special Enrollment Examinations (SEE) by the IRS. The three exams are administered by Prometric. Data provided by Prometric indicates the following exam pass rates for 2015-2016.

A person is not an Enrolled Agent until they pass all three exams.

Continuing Education

To continue as an Enrolled Agent, EAs must complete 72 hours of continuing education every three years. A minimum of 16 hours must be completed each year, including two hours in ethics.

Representation in Front of the IRS

Enrolled Agents have unlimited rights to represent taxpayers in front of the IRS. What that means is an Enrolled Agent can go in place of a taxpayer in a tax audit or some other tax dispute with the IRS. It is not necessary for the EA to have completed the tax return to represent the taxpayer. This is the same representation rights that CPAs and attorneys have.

If a tax dispute goes all the way to a tax court or district court, an enrolled agent will no longer be able to represent the taxpayer. At that point, an attorney must be hired or the taxpayer can choose to represent themselves. Like EAs, CPAs also do not have the authority to represent taxpayers in front of a court.

Why You Should Consider Using an Enrolled Agent

There is one distinct advantage of using an Enrolled Agent over a CPA or attorney. Since Enrolled Agents are credentialed by the IRS, a Federal agency, they can represent taxpayers in any state. CPAs and attorneys are overseen at the state level, so they can only represent taxpayers in states where they are licensed to practice. This means in many cases CPAs and attorneys can only represent in one state or a small number of states.

For taxpayers who want to have a long term relationship with a tax advisor or preparer, this is something worth considering. If the taxpayer moves out of state and at some point get audited, it is possible that their long-time CPA could not represent them. If the taxpayer had worked with an Enrolled Agent, the EA could represent them no matter which state they had moved to.

Conclusion

An Enrolled Agent is a tax professional that specializes in federal income taxation. EAs have the right to represent taxpayers across the entire country because they are credentialed directly by the IRS.

CPAs are professionals who may or may not specialize in taxation, but have passed a set of rigorous accounting exams. CPAs can represent taxpayers in the states where they are licensed.

Tax attorneys are legal professionals who specialize in tax law. Attorneys can represent taxpayers in the states where they are licensed.

No matter whether a taxpayer chooses an EA, CPA, or tax attorney for their tax needs, they can be confident the professional has shown a high level of knowledge.

¹ Pass rates are approximate. Data retrieved from https://www.prometric.com/en-us/clients/SEE/Documents/ResultsReportedforSpecialEnrollmentExaminations2016.pdf on 10/13/2016.